- #Nj tax refund status 2018 how to#

- #Nj tax refund status 2018 manual#

- #Nj tax refund status 2018 software#

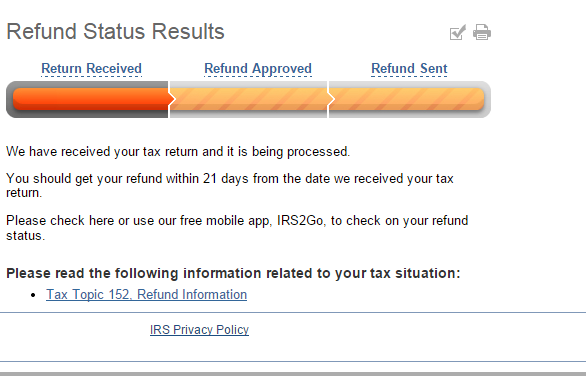

You might also experience a delayed return if you applied for a break like the Earned Income Tax Credit, if you had a complicated return or if you made some sort of mistake when you filed. If you submitted in paper, for example, then it may take longer for the agency to process its paperwork, according to the IRS site. That said, there are several reasons why your tax return might take a little longer. When you file electronically and use direct deposit to receive your money, the IRS should get you your refund within about three weeks of when you submitted your return.

#Nj tax refund status 2018 how to#

Here is a little primer to get you ready, with tips on when to expect your tax refund, how to track it down if it’s late - plus some smart ways to spend it once it’s in your hands.

For Americans holding an average of nearly $6,000 in high-cost credit card debt, the best move to make with a refund check is to pay off or make a big dent in those bills, a recent analysis by ValuePenguin suggested.īut let’s say you’ve already paid off your debts, a tax refund is on the way and you’re still brainstorming about how to put that money to good use? Among other activities, that cash is more than enough to cover a weeklong vacation for a family of four at Disney World (flights not included), a Tiffany ring, or a well-used 2004 Ford Mazda 6, according to listings on CarFax.Īlas, many younger consumers in particular may have already spent those tax refunds, whether they’ve received them or not! Nearly half of younger consumers said in a recent survey they planned to use their refund to help cover debt racked up through holiday spending - a higher rate than for the rest of the population.Īs it happens, a big tax refund can be a bit of a two-edged sword, particularly if it makes your pockets feel deeper than they actually are. Sorry your browser does not support inline frames.Filed your income tax returns ahead of the 2018 deadline and now itching to use your tax refund? There are lots of fun ways to burn through the roughly $3,000 that households will receive on average for their 2017 refunds. Please allow additional time for processing and review of refunds. To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests.

#Nj tax refund status 2018 manual#

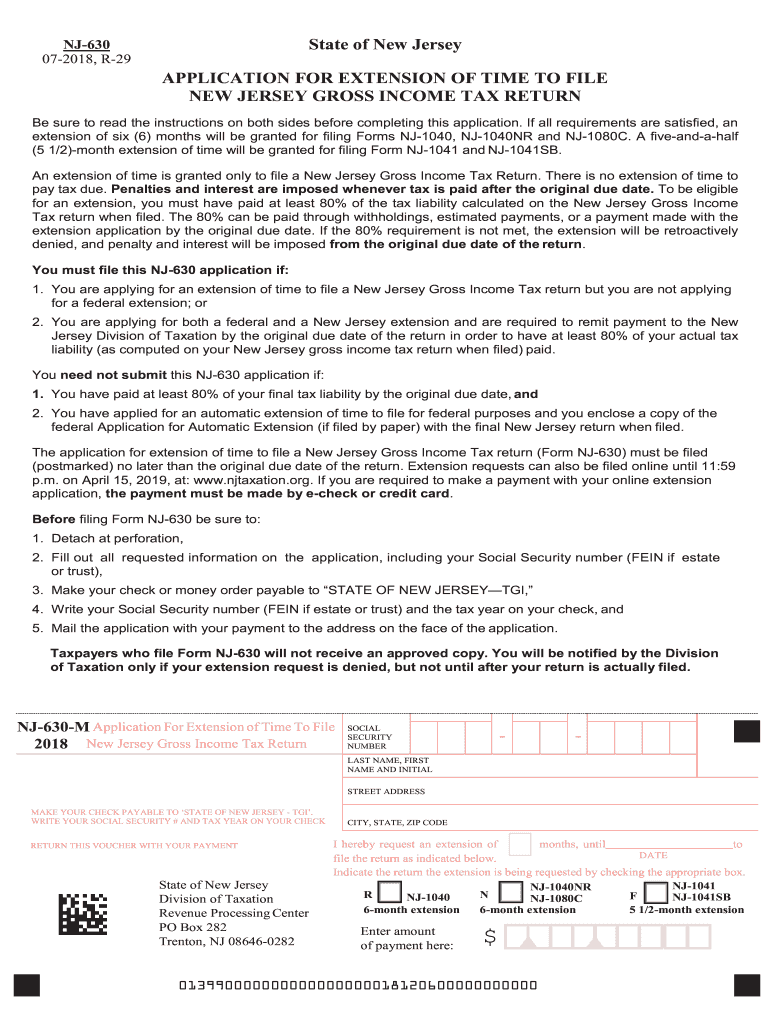

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper. In such cases, we cannot send a refund until the filer responds with the requested information. In some cases, they will send a filer a letter asking for more information. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly. We process most returns through our automated system. Processing of paper tax returns typically takes a minimum of 12 weeks. Electronic returns typically take a minimum of 4 weeks to process.

#Nj tax refund status 2018 software#

Generally, we process returns filed using computer software faster than returns filed by paper. Transferring information from returns to New Jersey's automated processing system Ģ.Ğnsuring that we transferred the information correctly ģ.Ĝhecking for inconsistencies as well as math and other errors. How New Jersey Processes Income Tax Refundsīeginning in January, we process Individual Income Tax returns daily.

0 kommentar(er)

0 kommentar(er)